Setting up a scottish trust deed

What is a Scottish trust deed?

A trust deed is a formal insolvency procedure and legally binding agreement that is available only in Scotland. It offers a great alternative to sequestration (bankruptcy) if you’re struggling with serious debt problems. A trust deed generally lasts 4 years after which, any remaining debt is written off.

Under a trust deed, your assets are transferred to a licensed insolvency practitioner, also known as a trustee, and you make a single affordable monthly repayment that is then distributed to the creditors you owe money to.

Once entered into a trust deed, your creditors can no longer contact you as all communication must now go through the trustee. Creditors included in the trust deed are also forbidden to further bother you for payment or pursue legal action against you.

Trust deeds can provide much-needed debt relief and a fresh start, but it’s important to understand the process of setting up a trust deed and to be aware of the implications before entering into one.

Am I eligible for a trust deed?

Trust deeds are a popular debt solution in Scotland, but not everyone is eligible to enter into one. In order to qualify for a trust deed, you must meet certain criteria.

Most importantly, if you are looking to enter a trust deed you must be a resident of Scotland and must have unsecured debts that equal or are more than £5,000.

In order to qualify for a trust deed, you must also have enough spare income after your necessary monthly expenses to make contributions to the trust deed for a minimum period of 48 months. Your spare monthly income is calculated by taking into account your disposable income after your essential living costs have been paid.

If an individual meets all of these criteria, then they may be eligible for a trust deed. However, it is important to note that entering into a trust deed is a serious decision with long-term implications. So make sure to research your option thoroughly before making a decision.

What creditors can be included in a trust deed?

Once you’ve decided that a trust deed is the right solution for you, the next step is to compile a list of creditors that you wish to include in the trust deed. Most people who enter into a trust deed have multiple creditors, but it is important to note that not all creditors can be included in the trust deed.

Trust deeds are used to pay off unsecured loans including credit cards, personal loans, and overdrafts. Other forms of borrowing such as store card, payday loans and catalogue debt is also included.

Debts that are not included in trust deed payments are any arrears on your mortgage or secured loans, child maintenance payments, student loans, and debts that have already been through the court process.

It is also important to note that some creditors may not agree to be included in the trust deed. In this case, you can still enter into the trust deed, but the creditor will not be bound by its terms.

Once you have compiled a list of creditors that you wish to include in the trust deed, the next step is to find a trust deed provider to administer the trust deed.

Trust deeds and trustees

A trustee is a licensed insolvency practitioner who is appointed to oversee your trust deed. The trustee’s role is to provide debt advice and manage your repayments and distribute them to your creditors.

The trustee is also responsible for ensuring that the terms of the trust deed are adhered to and that you meet your obligations. If you do not meet the terms of your trust deed, the trustee has the power to revoke the trust deed and pursue other debt solutions such as sequestration (the legal term for bankruptcy in Scotland).

What is the trust deed set up process?

Setting up a trust deed is a relatively straightforward process. The first step in the trust deed set up process is to find a licensed insolvency practitioner who is willing to act as your trustee. Once you have found a trustee, they will assess your financial situation and advise you on whether or not a trust deed is the best solution for you.

If you decide to proceed with a trust deed, the trustee will draw up a proposal. This document outlines the terms of the trust deed and includes information about your debts, assets, and income. This proposal will be sent to your creditors for approval.

If your creditors agree to the terms of the trust deed, they will sign it and it will become legally binding. Once the trust deed is approved, you will make monthly contributions to the trustee for a period of 48 months. These contributions will be used to pay off your debts.

Make sure your trust deed is protected

It is important to make sure that your trust deed is protected.

The main difference between a protected trust deed and a trust deed is that the former is legally binding. This means that your creditors have voted in favour of the new arrangement by a simple majority, and can no longer take legal action as long as you keep up with your monthly payments.

If you fail to make your monthly payments, your creditors can take legal action to recover the money they are owed. This could include seizing your assets and garnishing your wages. It is important to stay on top of your trust deed repayments to avoid any legal trouble.

How long does a trust deed last?

Scottish trust deeds are typically set up for a period of four years. During this time, fixed regular monthly payments are made to a trustee, who distributes the money to creditors.

However, it is possible for the term to be extended in some circumstances. If this happens, the trust deed will last for a period of five or more years. The trustee may extend the term if they believe it is in the best interests of the creditors or if the debtor encounters unforeseen financial difficulties.

This extension must be approved by at least two-thirds of the creditors however, if the majority of the creditors agree to an extension, it can give the debtor more time to repay their debts and avoid bankruptcy.

What happens when your trust deed ends?

When your Trust Deed comes to an end, your Trustee will issue a ‘letter of discharge’.

This letter confirms that you have completed the terms of your Trust Deed and all outstanding payments have been made. The letter of discharge will be sent to Accountant in Bankruptcy (AiB), the regulatory body of Trust Deeds in Scotland and the Register of Insolvencies will record your Trust Deed discharge.

Typically you will finish your trust deed within 48 months as long as all payments have been made on time during the plan. In those four years, the accumulation of all payments will count as full and final settlement of the unaffordable debts included in your trust deed.

Once you have been discharged from your Protected Trust Deed, you will be relieved of any outstanding debts that you had at the time of registration. This means that your lenders are no longer able to pursue any money that was owed to them when you entered into the Trust Deed. This allows you to have a fresh start and move on from your past financial mistakes.

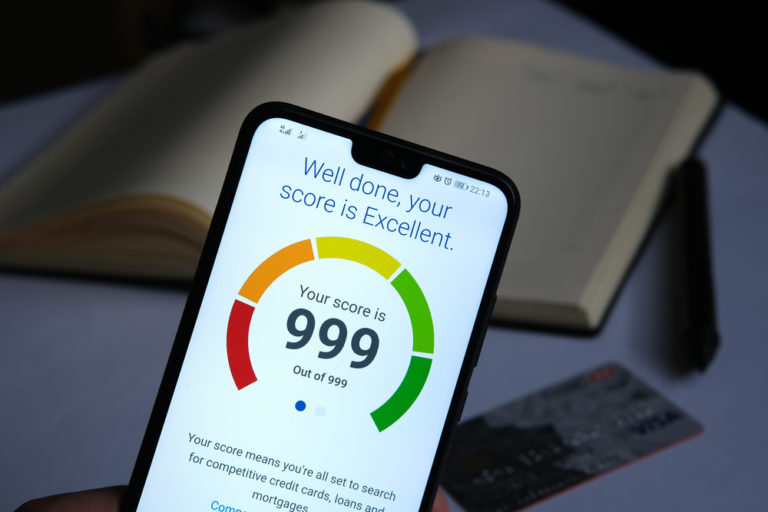

How long does a scottish trust deed stay on my credit file?

Once the trust deed is completed, it will usually remain on your credit file for six years. This may make it difficult to obtain new credit during this time, but after the six years is up, your credit rating will be updated to show that the debt has been discharged.

There are some lenders who may be willing to give you credit during the trust deed period, but they will usually charge a higher rate of interest. This is because you are considered a higher risk borrower. In this case, it is important to shop around for the best deal and make sure you can afford the repayments before taking out any new credit.

In some cases, a trust deed can be seen as a positive thing by future lenders as it shows that you took action to deal with your debt problem and are now in a better position to manage your finances.

How to rebuild your credit rating

Rebuilding your credit rating after a Trust Deed can be a challenge, but ther are a few things you can do to improve your chances of being accepted for new credit in the future.

- Make sure you are electorl roll, this is one of the ways creditors can verify your identity.

- View your credit file and make sure all debts included in the Trust Deed are marked as ‘satisfied’. This will show potential creditors that you have taken care of your debt problem.

- Don’t apply for too many credit products at once – this will negatively impact your credit rating. Spread out your applications over time.

- Apply for a credit card with low interest rates. This will help improve your credit rating over time.

Can I cancel my trust deed?

If you want to cancel your trust deed, you need to speak to your trustee for their expert debt advice first. They will assess your current financial circumstances and decide whether or not it is in the best interests of your creditors to cancel the trust deed. If the trustee decides that it is in the best interests of your creditors to cancel the trust deed, they will notify all of your creditors of the cancellation.

If you decide to cancel your trust deed, any assets that were included in the agreement become payable immediately. This means that if you own your home, it could be at risk of being repossessed. It is important to note that canceling your trust deed is a serious decision and should only be considered as a last resort.

What are the alternatives to a Scottish trust deed?

Debt Arrangement Scheme (DAS)

A Debt Arrangement Scheme (DAS) is a formal way to repay your debts over an extended period of time. This is also known as a Debt Payment Programme (DPP). Under a DAS, you make payments to a program administrator, who then distributes the money to your creditors. If you enter into a DAS, creditors are prevented from taking further action to recover the debt, such as applying for seizure of earnings or using bailiffs.

A DAS can cover most types of debts including utility bills, credit and store cards, personal loans, title deeds and hire purchase agreements. However, it does not cover certain types of debt such as student loans or fines imposed by the courts.

Debt Management Plan (DMP)

A DMP is an agreement between you and your creditors to pay all of your debts. Under a DMP, you make one monthly payment to the DMP provider, who then distributes the funds to your creditors. Because you repay your original debt under a DMP, it has much less effect on your credit score than protected trust deeds or sequestration.

Sequestration (Bankruptcy)

Sequestration, the legal term for bankruptcy in Scotland, is a last resort option for people with unmanageable debt. It is a legal process that gives you protection from your creditors and allows you to make a fresh start. Under sequestration, your assets are sold and the proceeds are used to pay off your debts.

Sequestration usually lasts for one year, after which your debts are discharged and you are no longer liable for them however, sequestration will have a serious impact on your credit score and will remain on public record.

FAQs

How much does a trust deed cost?

The cost of a trust deed can vary depending on the practitioner you work with, but typically, there are no setup fees, and the costs associated with running the trust deed are included in the monthly amount that you agree to pay back. This monthly amount will cover the administration of the trust deed, as well as the fees of the practitioner and any other associated costs.

How does a trust deed differ from a protected trust deed?

The main difference between a protected trust deed and a trust deed is that the former is legally binding. This means that your creditors have voted in favor of the new arrangement by a simple majority, and can no longer take legal action as long as you keep up with your monthly repayments.

If a trust deed is unprotected, it means that creditors may still undertake legal action against you. This can have serious consequences, including the addition of charges and interest to your debts. These additional amounts can significantly increase the overall amount that you owe, making it even more difficult to repay your creditors.

Is a trust deed a good idea?

The main advantage of a protected trust deed is that it can help you to get back on track with your finances. It gives you some breathing space and allows you to make smaller, more manageable payments each month. This can be helpful if you are struggling to keep up with your current repayments.

However, there are some disadvantages to be aware of. For example, a trust deed will have a negative impact on your credit rating, making it more difficult to borrow money in the future. Additionally, the arrangement is legally binding, which means that you could face serious consequences if you fail to make your payments.

Despite the disadvantages, a trust deed can be a good solution for people who are struggling to repay their debts. However it is important to speak to a debt advisor to find out if a trust deed is the right option for you.

Will a trust deed impact my career?

A trust deed will not affect your job unless your employer has a policy against employees who are in any form of insolvency. If this is the case, then you may need to disclose your trust deed to your employer.

Some employers may be more understanding than others, but it is always best to be upfront and honest with them.

What if my circumstances change during a trust deed?

If your circumstances change when you’re in a Trust Deed, the most important thing to remember is that you tell your Trustee of any financial changes that will prevent you from making the agreed payments. This could be something like a decrease in income, an increase in expenses, or a change in your ability to make regular payments.

If you do not let your Trustee know about any changes, they may take action to get the money you owe them.

Your Trustee is there to help make sure that your Trust Deed doesn’t fail. This means that they will work with you to come up with a repayment plan that you can afford. Your Trustee will also help to negotiate with your creditors so that you can get the best possible deal.

There is flexibility built into trust deeds, which allows for any unexpected situations that may arise. This means that the trust deeds can be tailored to suit each person’s needs, and can be adapted as needed. This makes the trust deeds a very effective way of getting out of debt, and can provide people with the fresh start they need.

Is a trust deed insolvency?

A protected trust deed is a formal debt management solution that is available to Scottish residents. It is a form of personal insolvency that was introduced in Scotland as a way to help people manage their debts. The Trust Deed process has been revised a number of times over the years, and it continues to be an effective way for people in Scotland to get their debts under control.

What’s the difference between a secured and unsecured debt?

A secured debt is any debt that is backed by an asset. The company lending you the money will use your asset as collateral if you can’t repay your loan, which means your lender has the right to take possession of your home, car or whatever asset was used to secure the loan. Common examples of secured debt include mortgages and car loans.

Unsecured debts is a term used to describe any type of debt that isn’t backed by any assets. This generally refers to loans and credit card debt, where the borrower doesn’t have to put up any collateral in order to borrow the money.

With unsecured debts there’s no guarantee that the borrower will be able to repay the debt, this results in unsecured debts often carries a higher interest rate than secured debt. Some common examples of unsecured debts include credit card balances, personal loans, and medical bills.