Entering into a trust deed, also known as a Scottish trust deed, can have an impact on your credit rating. Trust deeds are a form of insolvency in Scotland, and they will be recorded on your credit file for six years, which can make it difficult for you to obtain credit during that time. Additionally, your creditors will be informed of the trust deed, which may also negatively impact your credit rating. However, it’s worth noting that if you are struggling with debt and unable to repay your creditors, a trust deed may be a better option than other forms of insolvency such as bankruptcy.

What is a Trust Deed?

A Trust Deed is a formal agreement between an individual and their creditors, setting out the terms and conditions of how debts will be repaid. The person in debt (the debtor) will offer their creditors a set amount each month, which is proportional to the level of debt owed and the debtor’s income. The Trust Deed will often involve the debtor paying a set amount over an agreed-upon time frame, normally 4 years.

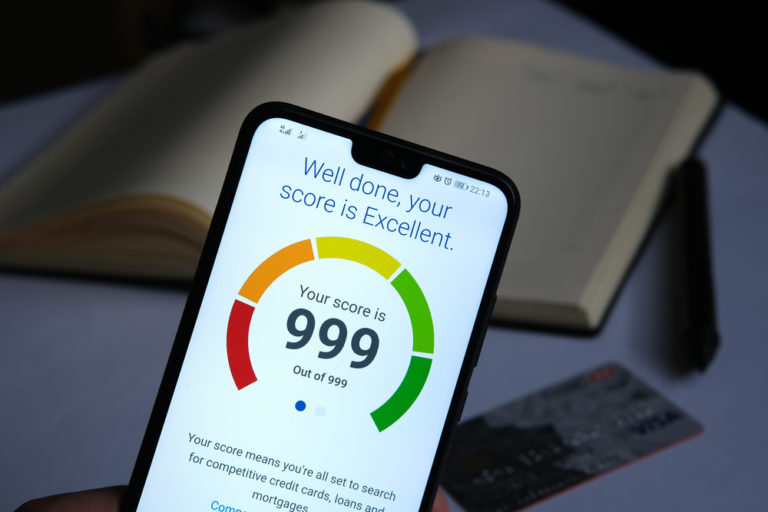

What Are Credit Ratings?

Credit ratings are a numerical expression that lenders use to assess the creditworthiness of an individual. It helps to determine whether a borrower is likely to repay their debts. Credit ratings are determined by an individual’s credit history and other factors such as income and assets. The higher the credit rating, the lower an individual’s risk of defaulting on loans. Credit ratings are important for obtaining loans and other types of credit.

How do lenders collect credit ratings?

Lenders typically collect credit ratings by using a combination of methods such as reviewing an individual’s credit report, asking the applicant to provide documents such as pay stubs and bank statements, and by performing a background check. Lenders may also use information from third-party services such as credit bureaus. This information is used to determine an individual’s credit rating, which lenders use when deciding whether or not to grant a loan.

How will a Trust Deed effect my credit rating?

A Trust Deed can have a negative effect on an individual’s credit rating. The process of entering into a Trust Deed will cause lenders to view the individual as a higher risk borrower, resulting in a lower credit rating. This can make it difficult for an individual to obtain loans or other types of credit in the future. Furthermore, it can take several years for an individual’s credit rating to recover after a Trust Deed has been completed. It is important that individuals consider the long-term impact a Trust Deed may have on their credit rating before entering into one.

Can I enter into a Trust Deed if I have a bad credit rating?

Yes, it is possible to enter into a Trust Deed even if you have a bad credit rating. A Trust Deed can offer individuals with debt problems a solution for managing their debts when other options are not available. It is important to note, however, that entering into a Trust Deed may result in further damage to your credit rating. Therefore, individuals should seek advice from a qualified financial adviser before entering into a Trust Deed. It is important to remember that a Trust Deed is just one of many debt solutions available. Individuals should do their research and seek advice from qualified financial professionals in order to find the most suitable solution for their situation.

How long will a Trust Deed be on my credit rating?

A Trust Deed will typically remain on your credit rating for six years from the date it is signed. After this time, the record will be removed from your credit report. During this period, other lenders may be able to see that you have entered into a Trust Deed when assessing your creditworthiness. It is also important to remember that the overall effect of a Trust Deed on your credit rating will depend on how well you manage your debts during the six-year period. Therefore, it is important to maintain a good credit rating by adhering to your repayment plan and making all payments on time.

Conclusion

By understanding what a Trust Deed is, how credit ratings are collected, and the impact a Trust Deed can have on an individual’s credit rating, individuals can make informed decisions about their debt solutions. It is important to remember that entering into a Trust Deed should always be done with the guidance of a qualified financial adviser. With the right advice, a Trust Deed can be an effective way of helping individuals manage their debt and get back on track.