When considering a Trust Deed to manage your debts, it’s essential to understand its duration. A Trust Deed is a formal, legally binding agreement between you and your creditors, which can significantly impact your financial future. Understanding how long a Trust Deed lasts will help you make an informed decision and prepare for life after the arrangement.

In general, a Trust Deed lasts for four years, but the duration may vary depending on individual circumstances. The specific terms of a Trust Deed are negotiated between you, your creditors, and the appointed Trustee. Taking the time to understand the details of your Trust Deed is crucial to ensuring a successful outcome.

During the Trust Deed period, you’ll make a single, affordable monthly payment. This payment is distributed among your creditors based on an agreed-upon plan. It’s important to bear in mind that, while a fixed duration means an end in sight, you must also maintain the necessary payments and obligations to avoid potential complications.

Trust Deed Basics

A Trust Deed is a formal, legally binding agreement commonly used in Scotland to help individuals struggling with debt. It involves a voluntary agreement between you, as the debtor, and your creditors to repay a portion of your debt over a set period, usually 4 years. Let’s explore the key players and elements in this arrangement:

Debtor: This is you, the individual who is in debt and seeking a solution to repay creditors.

Creditor: These are the companies or individuals to whom you owe money. They agree to the terms of the Trust Deed and participate in the repayment process.

Trustee: This is an insolvency practitioner who acts as the mediator between you and your creditors. They are responsible for setting up, managing and ultimately discharging the Trust Deed.

Secured creditors: These are creditors who hold security over your assets, such as a mortgage or car finance agreement. They are not usually included in a Trust Deed, and you must continue to make payments to them separately.

A Trust Deed is an attractive option to manage your finances and work towards a debt-free future. Some key benefits include:

- Legal protection: Upon approval, a Trust Deed becomes a legally binding agreement, protecting you from further legal action by your creditors.

- Single payment: You will make a single, affordable monthly payment to the Trustee, who will distribute it to your creditors.

- Written-off debt: Once the Trust Deed term is complete, any remaining unsecured debt covered by the agreement is written off, allowing you to make a fresh start.

But be aware of potential drawbacks:

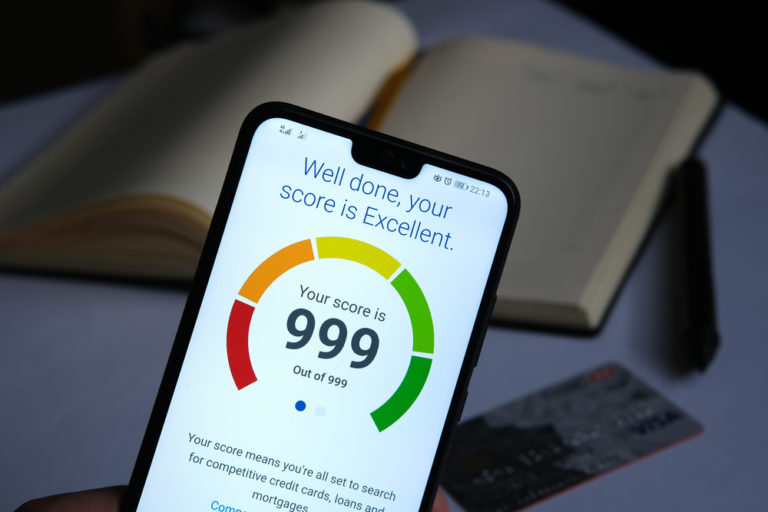

- Credit rating impact: Entering a Trust Deed will negatively impact your credit rating for six years, making it harder to obtain credit in the future.

- Loss of assets: Depending on the details of the agreement, you may need to sell valuable possessions (like your car) or release equity from your home.

A Trust Deed is a useful debt solution for many people in Scotland experiencing financial difficulties. Before committing to one, ensure you’ve considered all aspects and sought professional advice to determine if it’s the right choice for your individual circumstances.

Implementation Process

The implementation process of a Protected Trust Deed is an organised and well-structured series of steps you need to follow for it to be effective. This section will provide you with a brief overview of these steps and help you understand the key elements involved.

Step 1: Assessment and Proposal

First and foremost, take stock of your financial situation. Calculate your total unsecured debt and create a list of all your creditors. An insolvency practitioner (IP) can help you appraise your monthly income, living expenses, and come up with a realistic and affordable voluntary payment plan that suits your financial means. The IP will draft a proposal to send to your creditors on your behalf.

Step 2: Objections and Acceptance

Once your IP has created the proposal, your creditors will review it. Creditors have five weeks to submit objections to the Trust Deed. If less than 50% of your creditors (in terms of debt value) object, the Trust Deed will become a Protected Trust Deed and will prevent additional legal action against you for debt recovery.

Step 3: Registration on the Register of Insolvencies

After creditors have accepted the terms, your Trust Deed will be registered on the Register of Insolvencies. This record is accessible to the public and will remain there for the duration of the Trust Deed.

Step 4: Monthly Payments

As part of your agreement, you will make monthly payments to the IP, who will distribute the funds among your creditors. Your disposable income – the money you have left after covering living expenses – will determine the amount you pay each month.

Step 5: Completion

A typical Trust Deed lasts for a period of four years. After you have made all required monthly payments and fulfilled the terms of the agreement, you will be discharged from the Trust Deed. Any unsecured debt remaining will be written off.

Keep in mind that if you find it difficult to maintain the payment plan, your IP may recommend a Debt Arrangement Scheme (DAS), which allows for more flexible repayment terms.

A Protected Trust Deed is a helpful solution for getting control of your unsecured debts while avoiding further legal action. Take the time to understand the implementation process and work closely with a knowledgeable and supportive insolvency practitioner to make the most of this opportunity.

Managing Trust Deed Payments

When entering a Trust Deed, it’s crucial to manage your (monthly payment) effectively to ensure the Trust Deed succeeds. Here are some key aspects to consider in managing your Trust Deed payments:

- Assessing your income and assets: Before you can determine how much you can realistically afford to pay, start by evaluating all your sources of income and assets, including salary, benefits, pensions, and any other sources.

- Calculating your disposable income: Next, determine your disposable income by subtracting your essential living costs (rent, mortgage, utilities, food, etc.) from your total income. This figure will be used to set the amount you are required to pay monthly in your Trust Deed.

- Budgeting for regular payments: It’s crucial to create a budget that accommodates making regular payments within the Trust Deed period. You can seek assistance from a money adviser to help you develop a budget using common financial tools like the Common Financial Statement.

- Managing your property and equity: If you are a homeowner, you may need to secure the equity in your property. You should be aware of how this will affect your monthly repayments and adjust your budget accordingly.

- Tracking your credit file and report: Your credit file will contain information about your Trust Deed, which will affect your credit rating during the term of the arrangement. It’s essential to regularly monitor your credit report, being aware of any changes and managing your financial situation accordingly.

In the event that your financial circumstances change during the term of your Trust Deed, there are options to consider:

- Repayments reduced: If your disposable income has decreased, it is possible to request a review of your payment arrangement and potentially have your repayments reduced.

- Joint debts: If you have joint debts with another individual, communicate with them and your appointed Trustee as your Trust Deed may impact their financial responsibility.

Remember, managing your Trust Deed payments successfully may take effort and dedication. However, by being vigilant with your budget and collaborating with a knowledgeable money adviser, you can navigate through this financial arrangement with confidence and clarity.

The Aftermath of a Trust Deed

The aftermath phase of a Trust Deed can be thought of as the period after your Trust Deed has either been successfully completed or prematurely dissolved. During this time, you’ll likely experience a range of emotions and experiences related to your financial situation.

Discharge and Effects on Credit Rating

After completing your Trust Deed, you’ll be discharged from your unaffordable debts, usually after 4 years. This means that, typically, any outstanding debt you had will be written off and you’ll no longer be responsible for repaying it. However, be aware that the Trust Deed will be recorded on your credit reference agencies files and may affect your credit rating for up to six years. This can make it more difficult for you to obtain new credit, loans, or mortgages during this period.

Dissolution and Bankruptcy

If, for some reason, your Trust Deed becomes dissolved before completion, it’s not the end of the road for you. Should this occur, it is essential to discuss your next steps with your Accountant in Bankruptcy or a financial advisor. In some cases, an alternative debt solution like sequestration (the Scottish equivalent of bankruptcy) may be more appropriate if you’re unable to meet your Trust Deed obligations.

Employment Considerations

Securing a Trust Deed can have implications for your employment, particularly if you work in certain sectors such as financial services or government. It’s wise to check your employment contract and discuss your situation with your employer or HR department if necessary.

Advantages of a Trust Deed:

- Protection from further legal action by your creditors

- Affordable monthly repayments

- Debts written off upon successful completion

Disadvantages of a Trust Deed:

- Impact on credit rating for up to six years

- Potential employment restrictions

- Assets may be at risk if they’re included in the Trust Deed

The aftermath of a Trust Deed can be a time of opportunity and challenge. Understanding the benefits and drawbacks is essential to navigate the process successfully and make informed decisions about your financial future. Remember to seek advice from professional sources and maintain open and honest communication with all parties involved.