A Trust Deed is a legally binding agreement between you and your creditors, used specifically in Scotland to help manage unsecured debts. By entering into a Trust Deed, you agree to make regular payments towards your outstanding debts, and in return, your creditors agree to write off a portion of those debts at the end of the Trust Deed term.

This might seem like a viable option to regain control over your finances, but it’s essential to be aware of how a Trust Deed can impact your credit file.

When you sign a Trust Deed, it will be recorded on your credit file and remain there for six years from the start date. This means that during this time, you may find it more challenging to obtain credit, as lenders will see that you have entered into a formal debt solution.

It’s crucial to consider the impact of the Trust Deed on your credit file and your ability to borrow in the future before making a decision.

However, a Trust Deed can become an essential step in the right direction towards financial recovery. By working with a trustee to manage your debts, you have the opportunity to regain control over your finances and ultimately alleviate some of the burden caused by financial distress.

While your credit file may be affected during the six-year period, successful completion of a Trust Deed may enable you to rebuild your credit score and open more doors to borrowing in the future.

What is a Trust Deed?

A Trust Deed is a legally binding arrangement in Scotland that allows you to consolidate your unsecured debts, such as credit cards, personal loans, and overdrafts into a single, manageable monthly payment. It is a form of insolvency, and once it is protected, your creditors cannot take any legal action against you to recover their debt.

When entering into a Trust Deed, you will work with a qualified insolvency practitioner (IP) who will act as your trustee. Your trustee will:

- Assess your financial situation

- Calculate a realistic and affordable monthly payment

- Deal with your creditors on your behalf

- Distribute the payments among your creditors

A Trust Deed typically lasts for four years, during which you will make payments based on your disposable income. Once completed, any remaining unsecured debt will be written off.

It’s essential to carefully consider whether a Trust Deed is suitable for your circumstances and seek professional advice before committing to this debt solution.

What is a Credit File?

A credit file is a comprehensive record of your borrowing and repayment history. It provides an overview of your creditworthiness to lenders, helping them assess if you are a suitable candidate for loans, mortgages, or other forms of credit.

Among the vital components of your credit file are:

- Personal information: This includes your name, date of birth, current and previous addresses, and employment history.

- Credit accounts: A list of your past and present credit accounts, such as loans, mortgages, and credit cards, along with their respective opening dates, credit limits, and current balances.

- Payment history: A record of your repayments, detailing if they were timely or late. Late payments can significantly impact your credit score.

- Credit applications: Whenever you apply for credit, it creates a “hard search” on your record, which will remain visible to other lenders for up to two years.

- Public records: This comprises any County Court Judgements (CCJs), Individual Voluntary Arrangements (IVAs), or bankruptcies.

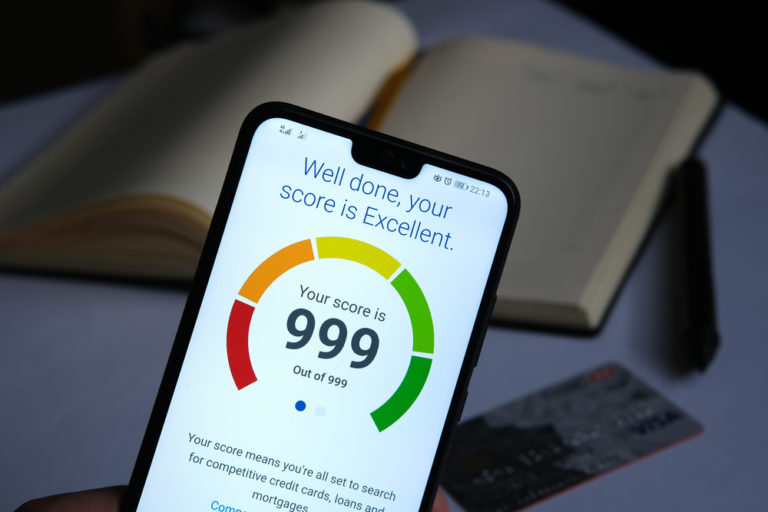

Three main credit reference agencies (CRAs) in the UK maintain credit files: Experian, Equifax, and TransUnion. They compile data from a variety of sources, primarily financial institutions, and generate credit scores based on the information in your credit file. These scores indicate your creditworthiness, allowing lenders to make informed decisions about extending credit.

You have the right to access your credit file, and it’s essential to check it periodically for any discrepancies or outdated information. Under the Data Protection Act, you can obtain a statutory credit report for a nominal fee or access it for free through websites like ClearScore, Credit Karma, and MoneySavingExpert’s Credit Club.

Regularly reviewing your credit file empowers you to work on improving it, increasing your chances of securing favourable credit rates and terms in the future.

Characteristics and Criteria of a Trust Deed

A Trust Deed is a debt solution tailored specifically for Scottish residents who are struggling with unsecured debts. In order to understand if a Trust Deed is the right solution for you, it’s important to consider its characteristics and criteria.

A Trust Deed is a voluntary, legally binding agreement between you and your creditors. It aims to help you manage your unaffordable debt by consolidating your unsecured debts into a single, manageable monthly payment, which is based on your disposable income. The key characteristics of Trust Deeds include:

- Duration: Trust Deeds typically last for 4 years, after which any remaining unsecured debt will be written off, provided you have met all the agreed terms.

- Credit Impact: Entering into a Trust Deed will have a negative impact on your credit file for 6 years from the start date.

- Protection from creditors: A Protected Trust Deed will prevent your creditors from taking further legal action against you, as long as you adhere to the terms and conditions.

To qualify for a Trust Deed, there are specific criteria that you must meet:

- Unsecured debt: The minimum amount of unsecured debt required for a Trust Deed varies, but it is generally around £5,000.

- Affordability: You must have a regular monthly income and be able to afford the agreed monthly payment after covering your essential living costs.

- Scottish residency: You must be a resident of Scotland, as Trust Deeds are only available to those living in the country.

- Equity: If you have any assets (such as a property), you may be required to release any available equity to contribute towards your debts. Keep in mind that certain assets may be excluded, such as tools required for your trade.

When considering a Trust Deed, it’s essential to carefully evaluate if this debt solution is the best fit for your financial situation. Remember that Trust Deeds only cover unsecured debts like credit cards, personal loans, and store cards. They do not cover secured debts such as mortgages or car finance. Also, bear in mind that entering a Trust Deed can affect your credit, making it more challenging to obtain credit in the future.

A Trust Deed is a valuable debt management tool designed to help Scottish residents regain control of their unaffordable debt and work towards a more stable financial future. If you believe that a Trust Deed may be suitable for you, it’s advisable to seek professional advice from a qualified debt advisor to discuss your options and assess if this is the most appropriate debt solution for your circumstances.

Impact on Credit Rating and File

A Trust Deed can have a significant impact on your credit file and rating. When entering into a Trust Deed, it is marked as a form of insolvency on your credit file, similar to bankruptcy. The key difference is that a Trust Deed usually lasts for a shorter period, typically around 4 years.

During the term of your Trust Deed, your credit score will likely be adversely affected. Lenders reviewing your credit report may view you as a higher risk, as the Trust Deed suggests that you have struggled with managing your debt in the past. However, it’s important to remember that every lender has their own set of criteria when assessing potential borrowers, so this impact may vary.

Credit reference agencies record the Trust Deed on your credit file for a period of six years from the start date. During this time:

- You may have difficulty obtaining new credit cards or loans.

- Existing credit lines might have limitations imposed or be closed entirely.

- Your trust deed will be visible to prospective lenders, affecting your ability to borrow in the future.

After your Trust Deed has been discharged, you can start rebuilding your credit history. It’s essential to address any default notices, as these will remain on your credit file for six years from the date of the default. You can request that the credit reference agencies update your file to reflect the completion of your Trust Deed. This will show that you have successfully resolved your financial difficulties and are taking steps towards better credit management.

To improve your credit score following a Trust Deed, consider the following steps:

- Register on the electoral roll: This can help credit reference agencies verify your identity and show stability in your living arrangements.

- Start with a low-limit, high-interest credit card: This can help you demonstrate responsible borrowing and timely repayments.

- Keep your utilisation ratio low: Try to use no more than 30% of your available credit and pay off balances in full each month.

- Check your credit report regularly: Stay up to date with your credit history, and address any discrepancies or errors as soon as possible.

By being proactive and demonstrating responsible credit use, you can lessen the impact of a Trust Deed on your credit rating and file. With time and a diligent approach, your credit score will gradually improve, and the presence of the Trust Deed in your credit history will hold less significance.

Advantages and Disadvantages of Trust Deeds

When considering a Trust Deed as a debt solution, it’s helpful to weigh the advantages and disadvantages. Here, we will discuss some of the key points to consider.

Advantages of a Trust Deed:

- Lower monthly payments: A Trust Deed can help you consolidate your debt and reduce your monthly repayments, making it more manageable for you to pay off your debts.

- Fixed repayment period: Trust Deeds have a fixed repayment period, typically lasting four years. Once this period is over, any remaining unsecured debt may be written off, allowing you to start with a clean slate.

- Protection from creditors: During the duration of your Trust Deed, your creditors are not permitted to contact you directly for payment. This can give you peace of mind and reduce stress related to debt collection.

- Avoids bankruptcy: Trust Deeds can offer an alternative to bankruptcy, helping you protect your assets, such as equity in your home.

Disadvantages of a Trust Deed:

- Impact on your credit file: A Trust Deed will stay on your credit file for six years from the start date, making it more difficult for you to obtain credit during this time.

- Monthly payments: Although your monthly repayments might be reduced with a Trust Deed, you still need to commit to making these payments. Failing to keep up with your repayments can lead to the failure of your Trust Deed and potential bankruptcy.

- Equity release: If you have equity in your property, you may be required to release some of this equity to contribute towards your Trust Deed repayments.

- Not suitable for all debts: Trust Deeds only cover unsecured debts. If you have secured debts, like a mortgage or secured loan arrears, these will not be included in the arrangement.

Considering these advantages and disadvantages, it is essential to carefully assess your financial situation and seek professional advice before entering into a Trust Deed arrangement.

Trust Deed Completion and Aftermath

Once your Trust Deed has been completed, you will be discharged from your debts. This means that you’re no longer responsible for the debts included in the agreement. Your Trustee will provide you with a discharge certificate as evidence of this.

Following the discharge, your details will be removed from the Register of Insolvencies. This will happen automatically within three months of the discharge. It’s important to monitor this and ensure your record has been updated accordingly.

However, the Trust Deed itself will remain on your credit file for a period of six years from its start date. This could have a negative impact on your financial position and may affect your ability to secure credit such as personal loans, overdrafts or mortgage applications.

To help mitigate the impact on your credit file, you should:

- Pay all of your ongoing bills and any new credit agreements on time to demonstrate you’re financially responsible.

- Regularly check your credit report and ensure the information is accurate and up-to-date.

- Build up your credit score slowly and cautiously by using a secured credit card or other types of affordable credit that can help you demonstrate your responsible borrowing.

During the Trust Deed, you may have struggled to obtain a bank account due to your financial situation. Many banks are reluctant to offer accounts to people who’ve undergone an insolvency process. After the discharge, you should try to open a new bank account to help rebuild your credit reputation.

It’s crucial to be aware that some employers in certain sectors (e.g. finance or law enforcement) may have policies that exclude individuals with past insolvencies. Therefore, your Trust Deed could have ramifications on your employment prospects even after the six-year period.

In conclusion, after the completion of a Trust Deed, there will be a period of financial recovery. It’s vital to use this time wisely and adopt responsible financial behaviours to rebuild your credit score and improve your financial position. Be patient, as this process will take time, but eventually, your credit file will recover, and your financial circumstances will improve.